Origin and Evolution of Money

|

Origin and Evolution of Money Barter Money, as we know it today, is the result of a long process. At the beginning, there was no money. People engaged in barter, the exchange of merchandise for merchandise, without value equivalence. |

||

| Then, a person catching more fish than the necessary for himself and his group, exchanged his excess fish for the surplus of another person who, for instance, had planted and harvested more corn that what he would need. This elementary form of trade prevailed at the beginning of civilization, and may be found today among people of primitive economies, in regions where difficult access makes money scarce and, even in special situations, where people barter items without regard for their equivalence in value. This is the case, for instance, of a child who exchanges with his friend an expensive toy for another of lesser value, which it treasures. |

|

|

|

Goods used in barter are generally in their natural state, in line with the environment conditions and activities developed by the group, corresponding to elementary needs of the group’s members. This exchange, however, is not free from difficulties, since there is not a common measure of value among the items bartered. Commodity Money Some commodities, for their utility, came to be more sought than others are. Accepted by all, they assumed the role of currency, circulating as an element of exchange for other products and used to assess their value. This was the commodity money. |

||

|

Cattle, mainly bovine, was one of the mostly used, and had the advantages of moving for itself, reproducing and rendering services, although there was the risk of diseases and death. | |

| Salt was another commodity money, difficult to obtain, mainly in the interior part of continents, also used as a preservative for food. Both cattle and salt left the marks in the Portuguese language of their function as an exchange instrument, as we keep using words such as pecunia (money) and pecúlio (accumulated money) derived from the Latin work pecus (cattle). The word capital (asset) comes from the Latin capita (head). Similarly, the work salário (salary, compensation, normally in money, due by the employer for the services of an employee) originates from the use of sal [salt], in Rome, for payment of services rendered. |

|

|

|

Brazil used, among other commodity moneys, cowry – brought by Africans –, Brazil wood, sugar, cocoa, tobacco and cloth, exchanged in Maranhão in the 17th Century due to the almost complete lack of money, traded in the form of yarn balls, skeins and fabrics. | |

| Later, commodities became inconvenient for commercial trades, due to changes in their values, the fact of being indivisible and easily perishable, therefore checking the accumulation of wealth. |

|

|

Metal As soon as man discovered metal, it was used to made utensils and weapons previously made of stone. |

||

| For its advantages, as the possibility of treasuring, divisibility, easy of transportation and beauty, metal became the main standard of value. It was exchanged under different forms. At the beginning, metal was used in its natural state, and later under the form of ingots and, still, transformed into objects, from rings to bracelets. |

|

|

| The metal so traded required weight assessment and assaying of its purity at each transaction. Later, metal money gained definite form and weight, receiving a mark indicating its value, indicating also the person responsible for its issue. This measure made transactions faster, as it saved the trouble of weighing it and enabled prompt identification of the quantity of metal offered for trade. | ||

Money in the Form of Objects Metal items came to be very valued commodities. As its production required, in addition to knowledge of melting, knowing where the metal could be found in nature, the task was not at the reach of everyone. The increased value of these objects led to its use as money and the circulation as money of small-scale replicas of metal objects.

|

|

|

|

This is the case of the knife and key coins found in the East and the talent, a copper or bronze coin with the form of an animal skin that circulated in Greece and Cyprus. | |

Ancient Coins In the 7th century B.C. the first coins resembling current ones appeared: they were small metal pieces, with fixed weight and value, and bearing an official seal, that is the mark of who has minted them and also a guaranty of their value. Gold and silver coins are minted in Greece, and small oval ingots are used in Lydia, made of a gold and silver alloy called electrum. |

||

|

Coins reflect the mentality of a people and their time. One may find political, economic, technological and cultural aspects in coins. Through the impressions found in coins, we are able to know the effigy of personalities who lived centuries ago. Probably, the first historic character to have his effigy registered in a coin was Alexander the Great, of Macedonia, around the year 330 B.C. | |

|

At the beginning, coin pieces were made by hand in a very coarse way, had irregular edges, and were not absolutely equal to one another as today’s ones. Gold, Silver and Copper The first metals used in coinage were gold and silver. Employment of these metals happened for their rarity, beauty, immunity to corrosion, economic value, and for old religious habits. In primeval civilizations, Babylonian priests, knowledgeable about astronomy, taught to people the close relationship between gold and the sun, silver and the moon. This led to a belief in the magic power of such metals and of objects made with them. |

||

|

Minting of gold and silver coins was common for many centuries, and pieces were guaranteed by their intrinsic value, that is to say, by the trade value of the metal used in their production. Then, a coin made with twenty grams of gold was exchanged for goods of even value. | |

|

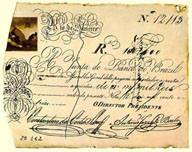

For many centuries, countries minted their most highly valued coins in gold, using silver and copper for lesser value coins. This system was kept up to the end of the last century, when cupronickel, and later other metallic alloys, became used, and coins came to circulate for their extrinsic value, that is to say, for their face value, which is independent from their metal content. With the appearance of paper money, minting of metal coins was restricted to lower values, necessary as change. In this new role, durability became the most requested quality for coins. Large quantities of modern alloys appeared, produced to support the high circulation of change money. Paper Money In the Middle Ages, the keeping of values with goldsmiths, persons trading with gold and silver items, was common. The goldsmith, as a guaranty, delivered a receipt. With time, these receipts came to be used to make payments, circulating from hand to hand, giving origin to paper money. In Brazil, the first bank notes, precursors of the current notes, were issued by Banco do Brasil in 1810. They had its value written by hand, as we today do with our checks. |

||

|

With time, in the same form it happened with coins, the government came to conduct the issue of notes, controlling counterfeits and securing the power to pay. Currently, all countries have their central bank in charge of issuing coins and notes. |

|

|

Paper money experienced an evolution regarding the technique used in their printing. Today, the printing of notes uses especially prepared paper and several printing processes, which are complementary to each other, assuring to the final product a great margin of security and durability conditions. Different Shapes Money has greatly changed its physical aspect along the centuries. |

||

|

|

Coins had already very small sizes, as the stater, which circulated in Aradus, Phenicia, and some reached large sizes, such as the thaler, a 17th century Swedish copper piece. | |

|

Although today the circular form is used in almost the whole world, there had been oval, square, polygonal and other shapes for coins. They were also minted in different non-metallic materials, such as wood, leather and even porcelain. Porcelain coins circulated, in this century, in Germany, when the country was under the economic hardships caused by the war. Bank notes were generally of rectangular lengthwise format, although with great variety of sizes. There are, still, square notes and those with inscriptions written in the vertical. Bank notes depict the culture of the issuing country, and we may see in them characteristic and interesting motifs as landscapes, human types, fauna and flora, monuments of ancient and contemporary architecture, political leaders, historical scenes, etc. Bank notes bear, in addition, inscriptions, generally in the country’s official language, although several also bear the same inscriptions in other idioms. The inscriptions, frequently in English, aim at permitting the piece to be read by a larger number of people. Monetary System The set of coins and bank notes used by a country form its monetary system. The system is regulated by appropriate legislation and organized from a monetary unit, its base value. |

||

| Currently almost all countries use a monetary system of centesimal basis, in which the coinage dividing the unit represents one hundredth of its value. |

|

|

|

Normally, higher values are expressed in notes while smaller values are represented by coins. The current world trend is that daily expenses be paid with coins. Modern metallic alloys enable coins to be more durable than notes, making them more appropriate to the intense use of money as change. The countries, through their central banks, control and guarantee the issue of money. The set of notes and coins in circulation, the so called monetary mass, is constantly renewed through the process of sanitation, substitution of worn out and torn notes Checks As coins and notes ceased to be convertible into precious metal, money became more dematerialized and assumed abstract forms. One of these forms is the check that, for simplicity of use and security offered, is being adopted by an increasing number of people in their day-by-day activities. |

||

| This document, by which one orders payment of a certain amount to its bearer or to a person mentioned in it, aims mainly at transactions with bank deposits. |

|

|

|

The important role played today in the economy by this form of payment is due to the innumerable advantages offered by it, speeding transactions with large sums, avoiding hoarding and diminishing the need of change by being a document completed by hand in the necessary amount. Money, whatever the form it has, is not valuable for itself, but for the goods and services it may purchase. It is a sort of security giving its bearer the faculty of being creditor of society and take advantage, through his or her purchasing power, of all conquests of modern man. Money was not, hence, invented by a stroke of genius, but stemmed from a need, and its evolution reflects, at each time, the willingness of man to harmonize its monetary instrument to the reality of its economy. |

||